Social Security Benefits Worksheet 2024 Pdf

Social Security Benefits Worksheet 2024 Pdf. The maximum benefit depends on the age you retire. No social security benefits are taxed.

No social security benefits are taxed. The maximum benefit depends on the age you retire.

The Maximum Benefit Depends On The Age You Retire.

Income between $25,000 and $34,000:

Up To 50% Of Your Benefits May Be Taxable.

No social security benefits are taxed.

For Example, If You Retire At Full Retirement Age In 2024, Your Maximum Benefit Would Be $3,822.

Images References :

Source: lessonlibtheiss.z19.web.core.windows.net

Source: lessonlibtheiss.z19.web.core.windows.net

Social Security Benefit Worksheet, Up to 50% of your benefits may be taxable. No social security benefits are taxed.

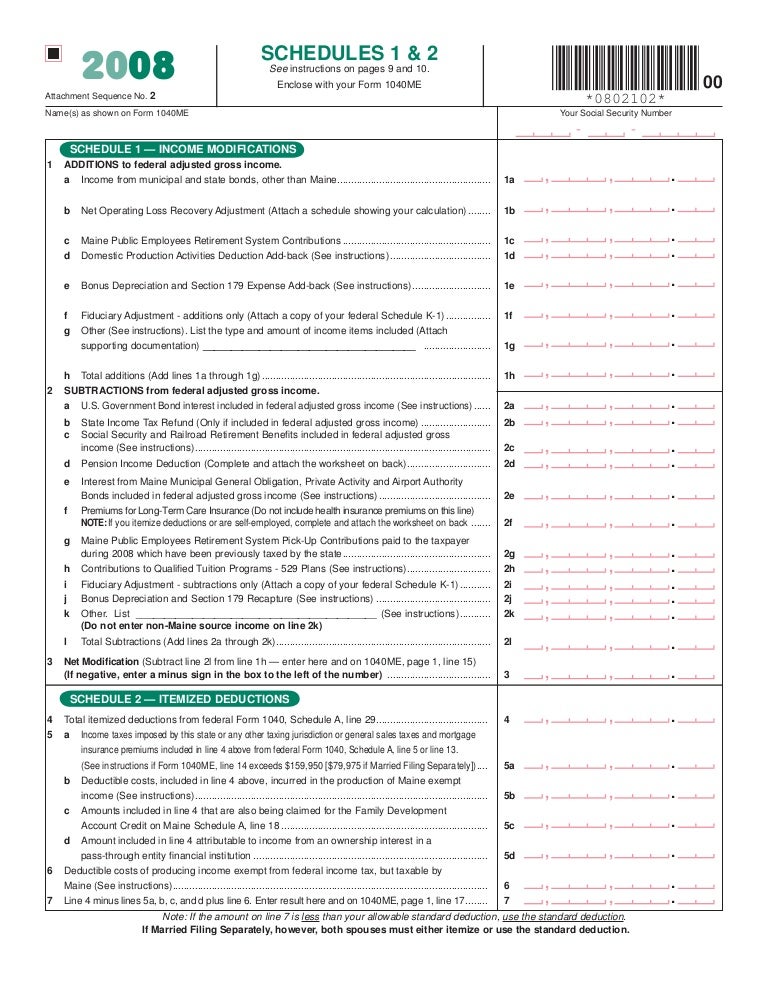

Source: www.unclefed.com

Source: www.unclefed.com

Social Security Benefits Worksheet, The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2024, your maximum benefit would be $3,822.

Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

20++ Social Security Benefits Worksheet 2019 Worksheets Decoomo, Income between $25,000 and $34,000: No social security benefits are taxed.

Source: worksheetmediaanthony.z21.web.core.windows.net

Source: worksheetmediaanthony.z21.web.core.windows.net

social security worksheet 2022, The maximum benefit depends on the age you retire. Income between $25,000 and $34,000:

Source: worksheetmediawulf.z19.web.core.windows.net

Source: worksheetmediawulf.z19.web.core.windows.net

Social Security Benefits Worksheet Lines 6a And 6b 2020, No social security benefits are taxed. Up to 50% of your benefits may be taxable.

Source: worksheetlibeisenhauer.z19.web.core.windows.net

Source: worksheetlibeisenhauer.z19.web.core.windows.net

Social Security Benefits Worksheet 2021 1040, The maximum benefit depends on the age you retire. Up to 50% of your benefits may be taxable.

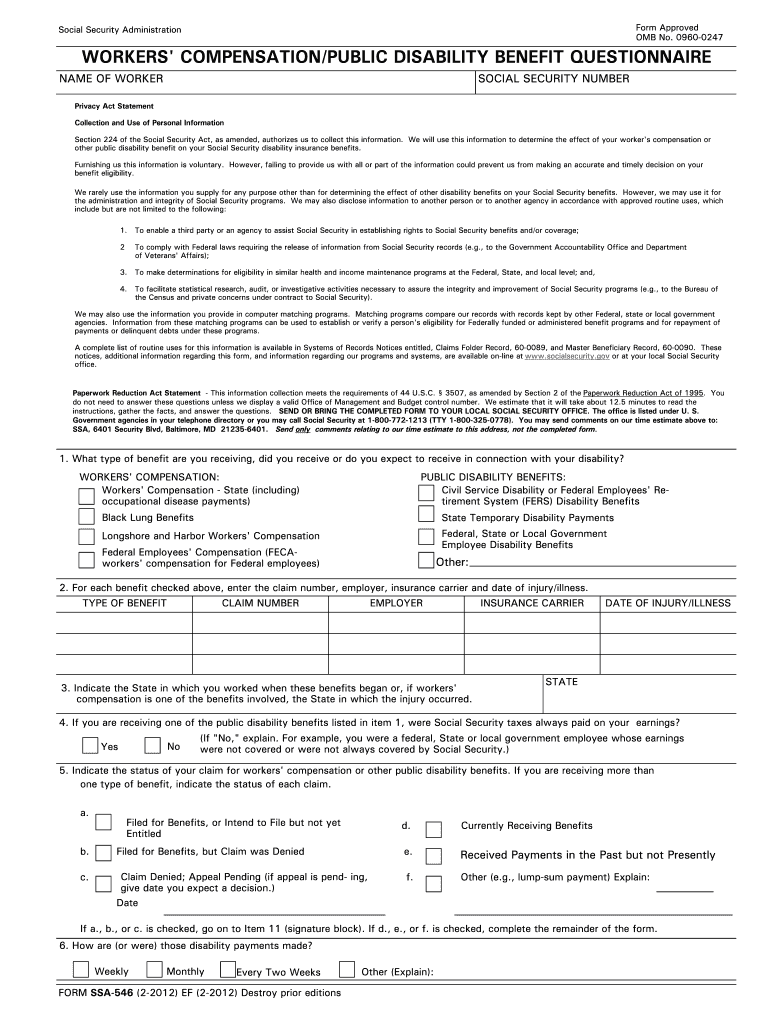

Source: www.dochub.com

Source: www.dochub.com

Social security compensation Fill out & sign online DocHub, For example, if you retire at full retirement age in 2024, your maximum benefit would be $3,822. Up to 50% of your benefits may be taxable.

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

Irs Worksheet For Taxable Social Security Benefits, Income between $25,000 and $34,000: For example, if you retire at full retirement age in 2024, your maximum benefit would be $3,822.

Source: www.taxablesocialsecurity.com

Source: www.taxablesocialsecurity.com

How To Determine Taxable Social Security Benefits, Up to 50% of your benefits may be taxable. Income between $25,000 and $34,000:

Source: www.oconnorlyon.com

Source: www.oconnorlyon.com

Form 1040 Line 6 Social Security Benefits — The Law Offices of O, Up to 50% of your benefits may be taxable. No social security benefits are taxed.

No Social Security Benefits Are Taxed.

Up to 50% of your benefits may be taxable.

The Maximum Benefit Depends On The Age You Retire.

Income between $25,000 and $34,000: